Companies need to think more carefully about how they offshore and outsource

Jan 19th 2013

The Economist

WHAT AND HOW much of its production to offshore to other countries is one of the most important choices a company can make. France’s two big carmakers illustrate the point. PSA Peugeot Citroën, the younger of the two, has tried over time to find cheaper places than around Paris to make its cars; in the 1950s and 60s Citroën opened a factory in Brittany and started manufacturing in Spain and Portugal, the China and Vietnam of their time for offshoring. Nowadays it makes cars cheaply in Slovakia and in the Czech Republic. But two-fifths of its global production is still in France, where it has seven expensive factories. One reason is that the company is family-owned, and families tend to be particularly loyal to their countries of origin.

Renault, on the other hand, has determinedly pursued a low-cost strategy, setting up factories in Morocco, Slovenia, Turkey and Romania, and now makes only a quarter of its cars at home. Unsurprisingly, it is Peugeot that is now in dire financial straits. Last autumn, amidst a fierce political storm, the company announced plans to stop car production at one of its biggest French factories, at Aulnay-sous-Bois, just outside Paris. But that may be too little, too late.

Yet there are also examples of highly successful companies that choose not to offshore to any great extent, even in labour-intensive industries. Zara, the main clothing brand of Inditex, a Spanish textile firm, is famous for making its high-fashion clothes in Spain itself and in nearby Portugal and Morocco. This costs more than it would in China, but a short, flexible supply chain allows the firm to respond quickly to changes in customer tastes. It sells the vast majority of its outfits at full price rather than at a discount. Its decision to stay close to home has become its main source of competitive advantage.

The practice of outsourcing is as old as business itself. A 19th-century manufacturing company might have had its own machines but not its own fleet of horse-drawn drays to distribute its wares. The fashion for what to subcontract and what to keep inside the firm has ebbed back and forth over time. At one time the conglomerate, owning everything it could, was all the rage, but for the past few decades firms have been outsourcing ever more of their operations, in the belief that as long as they kept the “core” of their business in-house, the rest could safely be sent anywhere in the world.

That belief has not always turned out to be justified. After Boeing, an aeroplane-maker, outsourced 70% of the development and production work on its new 787 Dreamliner to around 50 suppliers, it suffered huge delays because its outsourcing partners failed to produce parts on time. In 2005 Deloitte Consulting looked at 25 big companies that had outsourced operations and found that a quarter of them soon brought them back “in-house” because they could do the work themselves better and cheaper.

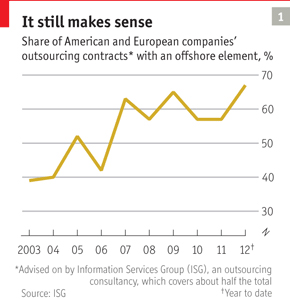

But most companies outsource to save money, so doing more of it has increasingly meant sending work to cheaper countries. In 2003, according to TPI, a company that advises on outsourcing, about 40% of all outsourcing contracts entered into by American and European firms involved offshore workers; that figure has since risen to 67%. In turn, companies that decide to offshore production often have little choice but to outsource as well. Local firms are often in a better position to operate in a particular environment, and they may control supply chains. Most of America’s and Europe’s textile industry, for instance, subcontracts work to outside firms in China, Vietnam and Bangladesh. Production of consumer electronics is largely outsourced to huge contract manufacturers such as Taiwan’s Foxconn and Quanta. This report concentrates on work that is done overseas, either inside the firm but in an offshore location or outsourced to foreign contractors, because this part of corporate globalisation has caused the most controversy.

Most firms do not give enough thought to choosing where to produce. To an alarming degree, says McKinsey, “companies continue to indulge in herd behaviour” when deciding where to base their operations and how to arrange their supply chains. Many of them, says the consulting firm, simply follow each other around to low-cost countries or allow themselves to be drawn in by governments waving wads of cash and other incentives.

David Arkless, head of government and corporate affairs for Manpower, which advises large companies on their locations, recalls the story of two rival technology firms from Idaho some years ago. One of them moved its production to the state of Penang in Malaysia. The other, having seen its foe reduce its labour costs by half and slash prices by 15%, pursued it to exactly the same place, he says. The pair quickly started competing for labour with each other and local wages soared. Mr Arkless has seen whole clusters of industries move to Shenzhen in tandem. “Within a year or so the labour costs go up to near the level of the original place,” he says. Manpower advises Western firms that if labour makes up 15% or less of their product’s total cost, they would do better not to offshore. And even if the share is higher, there is usually scope for improvement at home. “Going somewhere else for the sake of cheaper labour is usually a quick fix and avoids the real problems,” says Mr Arkless.

“Moving production a long way off and separating it from research and development risks harming a firm’s long-term ability to innovate”

Companies rarely analyse past location decisions to see whether they have proved right, note Michael Porter and Jan Rivkin of Harvard Business School in a paper, “Choosing the United States”, published last year. One reason why companies rush into offshoring may be that they are looking for a quick solution to existing troubles. According to “The Handbook of Global Outsourcing and Offshoring”, by Leslie Willcocks, Julia Kotlarsky and Ilan Oshri, companies are most likely to consider offshoring their operations when their profits are already falling.

Two sets of strategic problems can arise from offshoring production to another part of the world, especially if it is poorly thought out. The first of these concerns the logistics of supply. The more that firms spread their operations around the globe, the more vulnerable they become to disruption from unexpected events such as natural disasters or political unrest. The second strikes at the heart of what companies try to do: sell more and better widgets to customers than their rivals down the road. Often, the more a firm offshores and outsources, the worse it will be at responding to customers quickly.

Ideas factory

Over the past few decades it became conventional wisdom that factory jobs could be done cheaply in some far-flung corner of the world but more important innovation work should stay in-house in high-cost countries. Manufacturing was seen as just a cost centre, so it was often offshored. Now many companies reckon that production makes a big contribution to the success of research and development, and that innovation is more likely to happen when R&D and manufacturing are in the same place, so increasingly they want to bring manufacturing back in-house.

Foreign suppliers of parts not infrequently turn into competitors, and for many companies the risk of losing intellectual property either through theft or imitation in China and elsewhere remains high. Indeed, says Richard Dobbs of the McKinsey Global Institute in Seoul, big South Korean groups reckon that American and European companies are making a mistake in outsourcing as much manufacturing as they do, because this allows other firms a great deal of insight into their processes. They should know: Samsung, an electronics giant, was once an outsourcing partner for several Japanese firms but now dwarfs its former customers. South Korean firms offshore production to their own factories overseas, but they seldom outsource.

Many companies are now rethinking the outsourcing of ever more important functions. Lenovo wants to own more of its capacity in China and elsewhere; it gets better results from its own facilities than from its outside contractors, says Gerry Smith, the firm’s global head of supply chain. That often means taking the work back home.

The most prominent current example of the opportunities and risks of offshoring is the relationship between Apple and Foxconn. From a strategic point of view the partnership could not be more successful. In 2010 Foxconn took a huge chance by investing billions of dollars in building enough capacity in China to manufacture Apple’s iPhone on the scale required. It built a uniquely flexible and responsive supply chain for the American firm. On one recent occasion, according to a report in the New York Times, Apple redesigned the iPhone’s screen at the last minute and Foxconn woke up its workers in the middle of the night to get the job done in time. “The reason Apple is what it is today is Foxconn,” says a consultant in Taipei who prefers not to be named. The two companies, he says, are inextricably bound to each other.

But Apple may be wishing it was not quite so dependent on Foxconn. After a spate of reports of poor working conditions for the firm’s employees (including excessive hours), Apple’s chief executive, Tim Cook, ordered an investigation, and Foxconn is making a number of changes. Even so, the bad news has not stopped. In September Foxconn had to close a factory for a while when a brawl among employees turned into a full-scale riot. In October the firm admitted that it had employed “interns” as young as 14 in its factories. In December Mr Cook announced that Apple would bring some production of Mac computers back from China to America. He said the main aim was to create jobs in America, but the move may also appease critics of Apple’s partnership with Foxconn. The Taiwanese firm said that it, too, would expand its operations in America, explaining that important customers wanted more work done there.