Coffee market perks up

From 2008 to 2013, revenue in the retail coffee

market grew at an average annual rate of 5.6 percent

to $27.9 billion, according to Santa Monica, Calif.-

based IBISWorld’s May 2013 report “The Retail Market

for Coffee in the US.” The market research firm also

expects the retail coffee market to grow 5.7 percent this

year, says Industry Analyst Andrew Krabeepetcharat.

“Generally speaking, cultural and social trends are

the largest driving factors for the industry’s growth,”

Krabeepetcharat says. He notes that coffee now is often

used as a social device, similar to drinking alcohol in a

bar with friends, with the difference being that coffee

is acceptable for consumption during the day or night

and can appeal

to consumers

not yet of legal

drinking age.

The improving

economy

and shifts in

consumer

preferences also

have helped

the category

grow, according

to IBISWorld’s

report.

In addition,

recent research

about the health

benefits of

coffee might be

a motivator to

consumers to

start or continue

drinking coffee,

according to

Rockville,

Md.-based

Packaged Facts’

July 2013 report

“Single-Cup

Brew Beverage

Products in the

U.S.: Coffee Pods

and Beyond.”

Research shows

that coffee can

help reduce

a consumer’s

likelihood of developing Type 2 diabetes, Parkinson’s

disease, dementia, and certain types of cancers,

including prostate, endometrial and basal cell

carcinoma, it says. In addition, researchers have

determined that coffee drinkers have fewer heart

rhythm problems and strokes, and that coffee has

antidepressant effects and can extend a consumer’s life,

it reports, citing data from WebMD.

This growing interest in coffee is visible across most

formats within the category, says Dana LaMendola,

beverages associate for Chicago-based Euromonitor

International. From 2011 to 2012, fresh coffee beans

grew 9 percent in terms of value, standard fresh ground

coffee grew 11 percent, instant coffee grew 4 percent,

ready-to-drink (RTD) coffee grew 17 percent, and coffee

pods grew 109 percent, she says.

READY FOR MANY

Coffee companies are catering to time-crunched

consumers with RTD offerings. This format currently

is experiencing a resurgence as it recorded double-digit

growth in the last year for the first time since 2007,

Euromonitor’s LaMendola says. At present, this format

makes up 17 percent of the coffee market, she says.

Earlier this summer, Seattle-based Starbucks Coffee

Co. released a line of single-serve, ready-to-drink

iced coffees for on-the-go consumption. Inspired by

the handcrafted iced coffees made at the company’s

coffeehouses, Starbucks Iced Coffee drinks are made

from 100 percent Arabica coffee beans; blended with

2 percent milk; and available in Vanilla Iced Coffee,

Caramel Iced Coffee, Iced Coffee + Milk, and Low-

Calorie Iced Coffee + Milk varieties.

Most recently, coffee companies have expanded

these formats into multi-serve cartons. In March 2012,

International Delight, a brand of WhiteWave Foods

Co., Denver, released Original, Mocha and Vanilla iced

coffees in ready-to-serve, half-gallon containers. The

iced coffee line combines coffee, real milk and cream in

a ready-to-serve, half-gallon container, bringing coffeeshop-

quality iced coffee home, the company says. This

year, the company expanded the line with Vanilla Light

and Mocha Light iced coffees with one-third fewer

calories than the regular iced coffees.

Also entering the multi-serve coffee segment,

Starbucks released into broad distribution its Starbucks

Discoveries Iced Café Favorites. Available in Caramel

Macchiato, Caffé Mocha and Vanilla Latte varieties,

the RTD coffees balance Starbucks espresso from

100 percent Arabica beans with 2 percent milk and

natural flavors with 120 calories in each

8-ounce serving, the company says.

Overall, the growth in the RTD

format, particularly iced coffees,

shows that home coffee brewing is

not overshadowing this segment,

Euromonitor’s LaMendola says. In

fact, IBISWorld expects that RTD coffee

offerings will continue to grow during

the next five years.

SINGLE-SERVE UPSWING

Consumers also are interested in

more convenient methods of brewing

and consuming their coffee at home,

according to experts.

For this reason, among others,

single-cup at-home coffee brewing

has exploded in the last few years,

according to Packaged Facts. In 2012,

dollar sales of single-cup coffee grew

82 percent to $922 million, it reports.

Experts estimate that single-cup sales

now account for more than 25 percent

of total dollar coffee sales in grocery

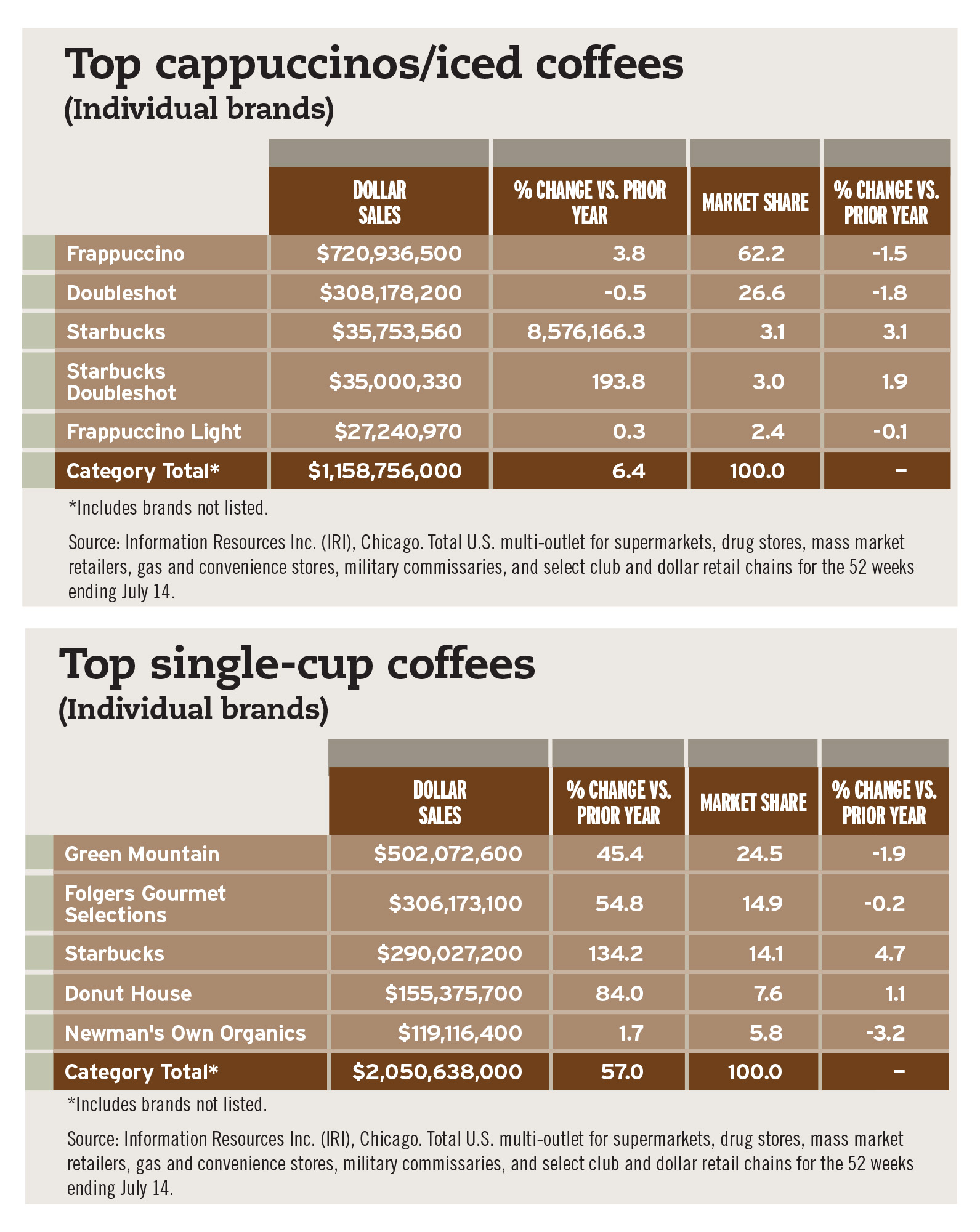

stores, it adds. Green Mountain Coffee

Roasters (GMCR), Waterbury, Vt.,

controls approximately 60 percent of

single-serve sales across various brands,

followed by Starbucks with 18 percent,

and The J.M. Smucker Co., Orrville,

Ohio, with 16 percent from its Folgers

Gourmet Selections and Millstone

brands, it reports.

In addition, research by the NCA

showed that 10 percent of households

owned a single-cup coffee brewer in

2012, up from 3 percent in 2007, and

36 percent of respondents had

purchased their brewers in the last

6 months. Forty-nine percent of

purchasers used the single-cup brewers

to replace their old brewers, while

34 percent continue to use their old

brewer in addition to their single-cup

brewer, it adds.

Packaged Facts reports that

69 percent of consumers surveyed

in 2012 indicated that they use their

single-cup brewers to prepare 70 to

100 percent of the coffee they consume,

while 31 percent report using them to

make 29 percent of their coffee or less.

A February poll by Harris Interactive

Inc., Rochester, N.Y., also found that,

among adults with single-cup coffee

makers, 70 percent say they have

consciously chosen to use it instead

of buying a drink at a coffee shop.

Euromonitor’s LaMendola says this

might be because consumers perceive

the investment in coffee pods and

single-cup brewing equipment to be

less expensive than purchasing coffee

on-premise.

Utilizing single-cup brewing

machines as well as other coffee

formats, consumers can make branded

coffee-shop-style drinks at home. For

example, Canton, Mass.-based Dunkin’

Brands Inc.’s Original Blend, Dunkin’

Dark Roast, French Vanilla, Hazelnut,

Dunkin’ Decaf and seasonal Mocha

coffee varieties are available in K-Cups

for single-serve coffee brewing through a

partnership with GMCR.

This summer, the duo also welcomed

iced coffee to the single-cup format

with the release of Dunkin’ Donuts

Original Blend Iced Coffee K-Cup

packs. The packs are brewed hot directly

over ice to allow consumers to enjoy

Dunkin’ Donuts iced coffee at home, the

companies say.

“Our iced coffee has long been a

favorite way for our guests to keep

refreshed and keep running throughout

their busy days. In fact, iced coffee

is fast becoming as popular as hot

coffee in our restaurants,” said John

Costello, Dunkin' Brands president of

global marketing and innovation, in a

statement. “We’re excited that we are

now able to offer Iced Coffee K-Cup

packs so people can experience and

enjoy our legendary iced coffee at home

or at work, any time of day.”

Also working in the single-cup

segment, Starbucks Coffee Co.

recently signed a five-year agreement

with GMCR to expand their

partnership, which started in 2011,

for the manufacturing, marketing,

distribution and sale of Starbucks- and

Tazo-branded single-serve packs for

use in GMCR’s Keurig single-serve

brewing systems globally. Under

the new agreement, Starbucks will

add brands and varietals, including

Seattle’s Best Coffee and Torrefazione

Italia coffee, to the Starbucks K-Cup

portfolio of offerings, ultimately

tripling the number of Starbucks

products on the Keurig platform.

With the expiration of GMCR’s patents

on K-Cups in September 2012, smaller

brands also have moved into the singlecup

space. In July, Internet-based coffee

company Coffee.org released Miss Ellie’s

Coffee Breakfast Blend light roast, Donut

Shop medium roast, and Dark Roast

varieties in 24-count RealCup boxes. The

newly patented RealCup design allows

consumers to instantly brew Miss Ellie’s

Coffee and is compatible with Keurig

coffee makers, the company says.

Packaged Facts estimates that private

label single-cup coffee sales could grow

from about $125 million this year to

$750 million in 2016. As of April, private

label sales represented less than 3 percent

of the U.S. single-serve market, it states.

Euromonitor’s LaMendola agrees that

private label shows significant growth

potential in the single-serve market as

consumers have grown to trust private

label coffee in other formats.

GRINDING INTO THE FORMATS

Ground roasted coffee remains the most

popular type of coffee, making up

73.6 percent of the revenue in the coffee

market, according to IBISWorld’s June

2013 report “Coffee Production in the

US.” In fact, 55 percent of respondents

to a 2011 NCA survey reported drinking

traditionally brewed coffee the day prior

to the survey, including 17 percent that

drank traditionally prepared gourmet

coffee, IBISWorld reports.

Within this segment, Folgers,

Maxwell House, private label, Starbucks

and Dunkin’ Donuts brands earned

the Top 5 spots on Chicago-based

Information Resources Inc.’s (IRI) list

of the top ground coffee brands for the

52 weeks ending July 14.

IBISWorld’s Krabeepetcharat notes

that brand recognition and reputation

is a highly important factor for coffee

consumers. “Coffee drinkers are less

inclined to purchase coffee they have

never tried or [that] has not received

any recommendations,” he says. “However, premium

coffee drinkers are more likely to buy less well-known

brands in order to discover new tastes.”

Newer brands of ground coffee are giving consumers

even more flavor and taste options within the format.

Magnum Coffee Roastery, Nunica, Mich., recently

launched its Magnum Taste of the Exotics line of four

coffees in California, with plans to expand distribution

into other states this year and nationwide next year, the

company says.

Magnum Coffee Roastery’s gourmet portfolio

includes Jamaican Blue Mountain and Kona Hawaiian

blends in 12-ounce packages of ground coffee as well

as two other whole-bean coffees in 10-ounce bags, the

company says. All blends are made from Fair Tradecertified

Arabica beans, in line with the rising trend of

ethical consumerism, it adds.

For a seasonal flair, The Coffee Bean & Tea Leaf,

Los Angeles, released its Pumpkin Spice and

Cinnamon Hazelnut coffees this month. Pumpkin

Spice is a medium roast Colombian blend ground

coffee that features pumpkin flavors with notes

of cinnamon spice and a hint of cream, while

Cinnamon Hazelnut is a full-bodied medium

roast with the flavor of freshly ground cinnamon

and lightly toasted hazelnuts, the company says.

Both blends will be available through November,

according to the company.

The increased availability of a wider range of

coffee flavors in supermarkets and grocery stores

has stimulated demand and raised awareness

of the gourmet and specialty coffee segment,

IBISWorld notes.

In addition, the increased prevalence of lighter

roasts, like Starbuck Coffee Co.’s Blonde Roast, and

medium roasts, like those mentioned above, has

helped to attract consumers who are seeking lighter

coffee flavors, do not enjoy the taste of coffee, or

want to drink coffee only for its caffeine content,

as well as regain consumers who have switched to

energy drinks, according to Euromonitor.

Despite ground coffee’s market dominance,

IBISWorld expects that its popularity will decline as

the premiumization trend influences consumers to

choose whole coffee beans for fresh grinding at home.

Although not as convenient as purchasing ground

coffee, whole beans often are preferred by coffee

connoisseurs because freshly grinding the beans at

home brings out the flavor of the beans, it says.

From 2008 to 2013, the whole-bean coffee format

gradually increased in popularity and now accounts for

13.4 percent of market revenue, IBISWorld reports.

Source by

www.bevindustry.com